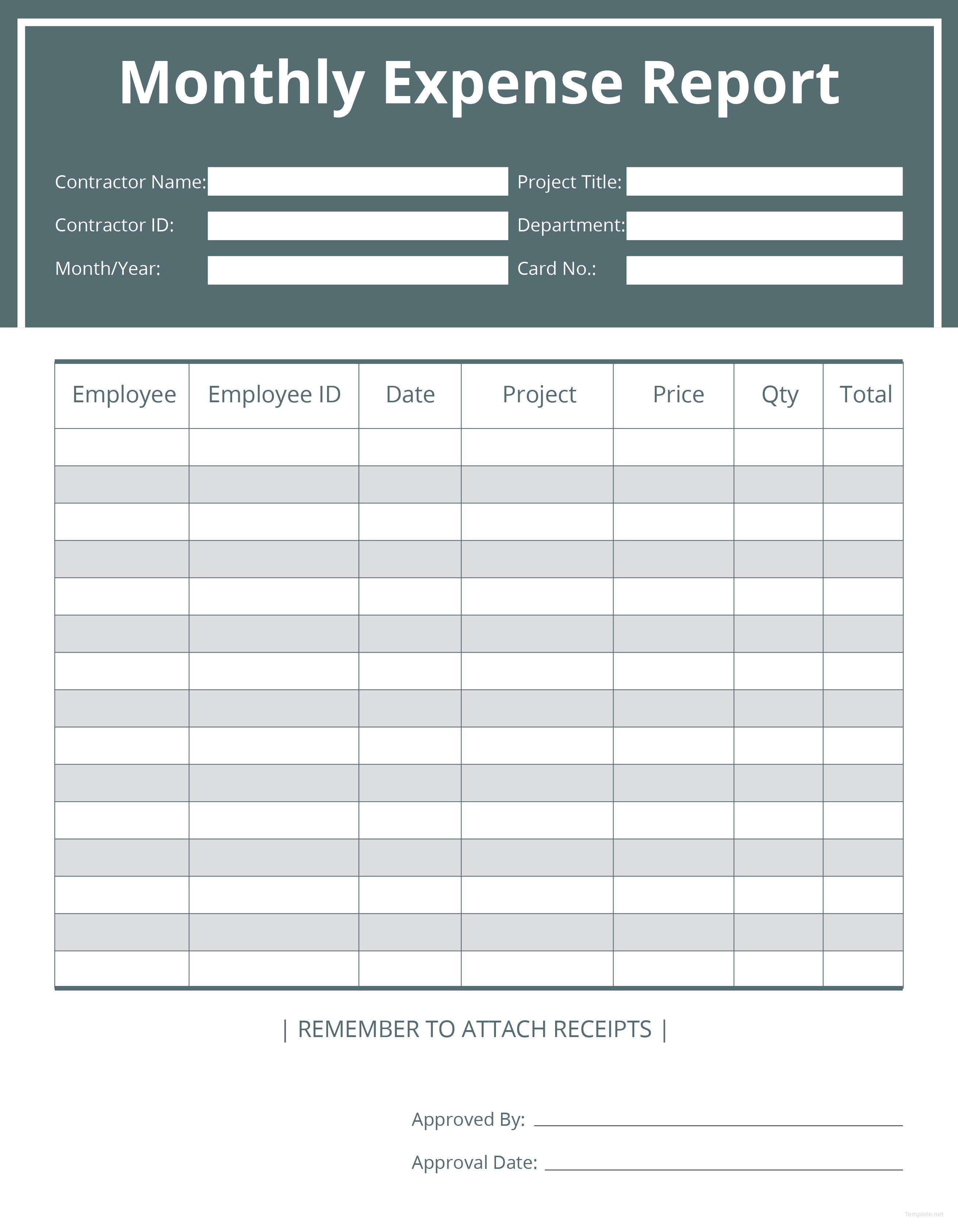

Fox received national attention for having a perfect credit score.Īn independent contractor expenses spreadsheet is also useful for identifying saving opportunities. You can use a credit reporting service to help you get these expenses (insurance payments, phone and Internet bills, etc.) to appear on your credit reports and help boost your credit score. However, one of the easiest ways to improve your credit score as a freelancer is by proving that you are paying your business bills regularly and on time. A common myth is that freelancers and independent contractors can’t have good credit because they aren’t receiving regular paychecks. With this information handy, you’ll be able to maintain good credit. Use this tool to keep a reliable historical record of your financials. Instead, you need a system for tracking your costs, so you know how much room you have to invest in your business and can properly file your taxes.Īn independent contractor expenses spreadsheet does just that. When you’re self-employed, you don’t have the luxury of an employer covering your work expenses. Benefits of using an independent contractor expenses spreadsheet From this spreadsheet, you can sort and filter your financial data and perform calculations via formulas and functions. What is an independent contractor expenses spreadsheet?Īn independent contractor expenses spreadsheet is a table-often created through Microsoft Excel or Google Sheets-that tracks your costs as a freelancer.

#Contractor expenses template software

With an independent contractor expenses spreadsheet or software tool, you’ll be set to track your business costs accurately and all by yourself, no tax professional needed. Thankfully, you can balance your own books and nab back tax savings with expense tracking platforms. These mistakes aren’t just annoying-they often mean missed opportunities to save money. 21% also said that trying to do their own accounting was one of the biggest beginner mistakes they made when entering the world of freelancing. Have you ever struggled to manage your financials as an independent contractor? If the answer is yes, you’re not alone.Īccording to Freelancer Map’s 2021 study, 25% of freelancers consider accounting one of the greatest challenges of self-employment.

0 kommentar(er)

0 kommentar(er)